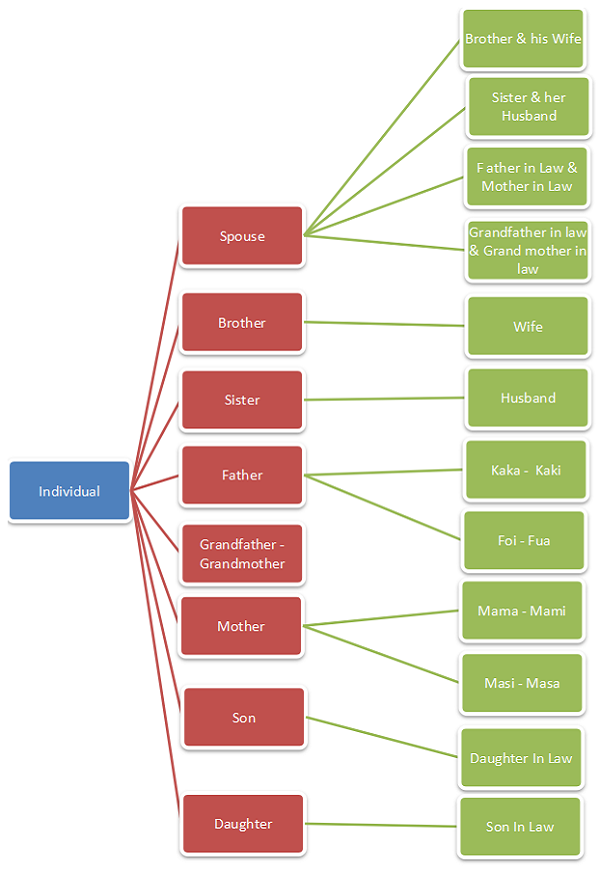

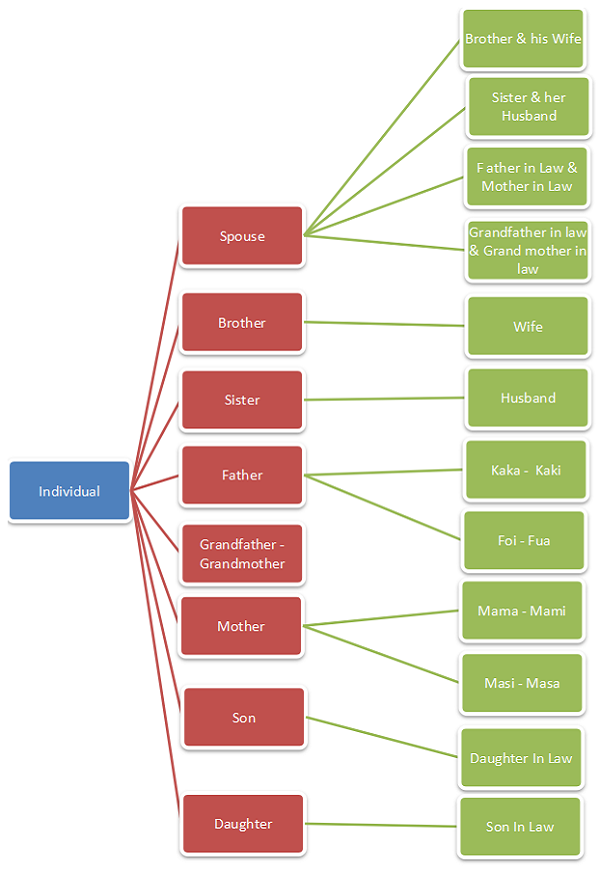

This article provides list of relatives covered Section 56(2)(VII) of the Income Tax Act,1961. As per Section 56(2)(VII) if any gift received from relative which are covered under following list will be exempt in the hands of receiver.

However the definition of the term ‘Relative’ which is given in the 1 st explanation to the proviso to section 56 (2)(VII) is very wide in its own.

Hence the following list and chart is a simplification of that definition for the ready reference of readers.

| Sr no. | Relative | Covered under |

| 1. | Husband/wife | Clause(i) |

| 2. | Brother and his wife | Clause(ii)with(vii) |

| 3. | Sister and her husband | Clause(ii)with(vii) |

| 4. | Wife’s bro. and his wife | Clause(iii)with(vii) |

| 5. | Wife’s sister and her husband | Clause(iii)with(vii) |

| 6. | Kaka – Kaki | Clause(iv)with(vii) |

| 7. | Fua – Foi | Clause(iv)with(vii) |

| 8. | Mama – Mami | Clause(iv)with(vii) |

| 9. | Masa – Masi | Clause(iv)with(vii) |

| 10. | Father – Mother | Clause(v)with(vii) |

| 11. | Grandfather – Grandmother | Clause(v)with(vii) |

| 12. | Son and his wife | Clause(v)with(vii) |

| 13. | Daughter and her Husband | Clause(v)with(vii) |

| 14. | Father in Law and Mother in Law | Clause(vi)with(vii) |

| 15. | Grand Father in Law (GFIL) and Grand Mother in Law (GMIL) | Clause(vi)with(vii) |

(Republished with Amendments)