One of the most important sections from Transfer of Property or TPA is transfer of Benefit of unborn persons which is mentioned in Section 13. Generally in Transfer of Property Act deals with the transfer of property from one living person to another living person. But this section 13 of TPA, is an exception to this case. To understand the topic clearly, you need to know about Section 14, Section 16 and Section 20 of Transfer of Property Act, 1882. We have separate blogs about these sections. After reading this blog, please go check out the other blogs.

According to TPA an unborn person

-May be in the womb of the mother

-May not be in the womb of the mother

So, it’s not necessary to be in the womb of the mother.

Hindu Joint Family– Child in the womb can ask share in the property.

Muslim Law/Mohammedan Law– Child in womb has no right in the property.

So, Muslim law doesn’t give any consideration regarding unborn child. But in Hindu Law, it gives consideration regarding unborn child.

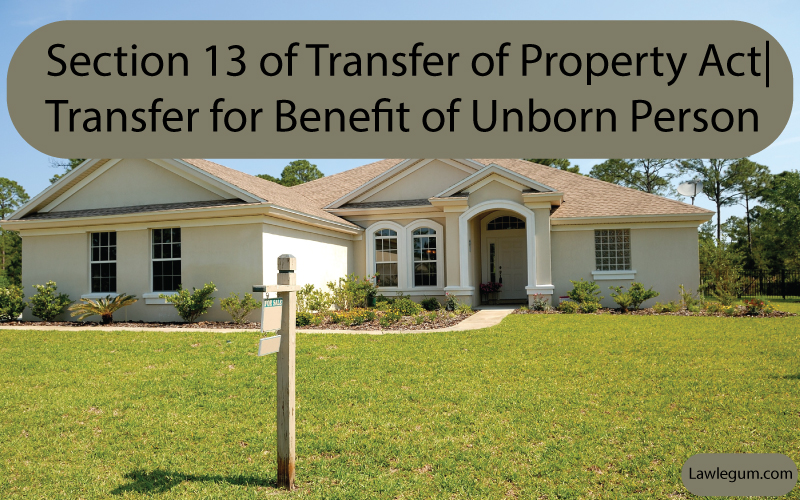

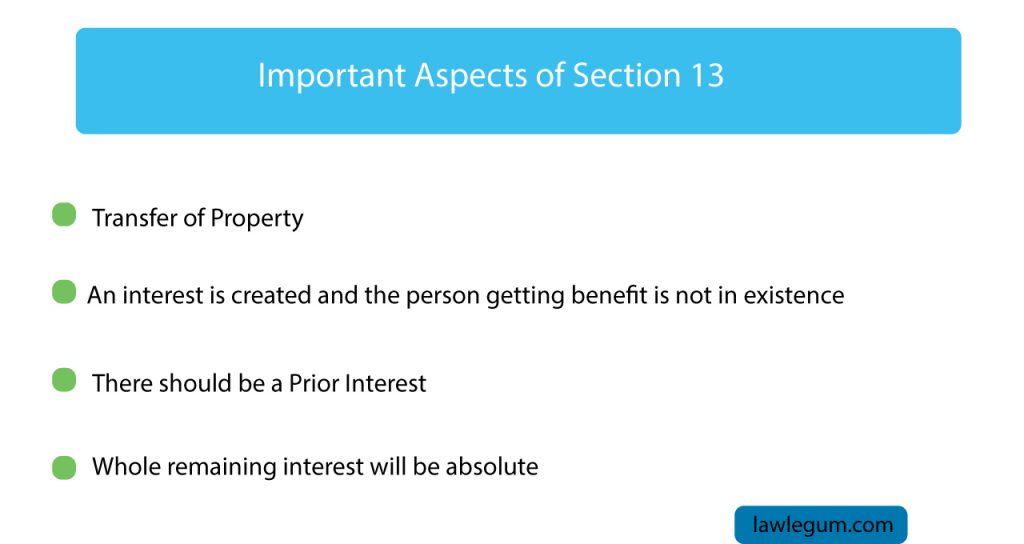

From the section, we can see that it talks about four important aspects. They are,

1.There has to be a transfer of property.

2.An interest is created and the person getting the benefit is not in existence when the interest is being created.

3.There should be a prior interest. We have discussed more about it in the below.

4.The whole of the remaining interest that is Absolute interest should be vested to the unborn person.

To understand more clearly, let’s see these following illustration and try to answer in which cases, there can be a transfer of property.

In illustration 1, it is not valid. Because there is no prior interest available. So it’s not a valid transfer.

In illustration 2, it is also not valid. Because only one unborn child will get absolute interest and it will be end there. So, it’s also a void transfer.

In illustration 3, This is also void because of age. It says 21 years. But the majority of years can be 18 and not more.

In illustration 4, it’s also a void transfer unless a child is born within the period of 9 months or 280 days. It is mentioned in Section 16 of Transfer of Property Act, 1882. We will discuss it in details in Section 14.

In illustration 5, It’s a valid transfer. Because there is a prior interest created and the child is born before the death of B that is to whom the prior interest is created.

So, only the illustration 5 is a valid transfer.

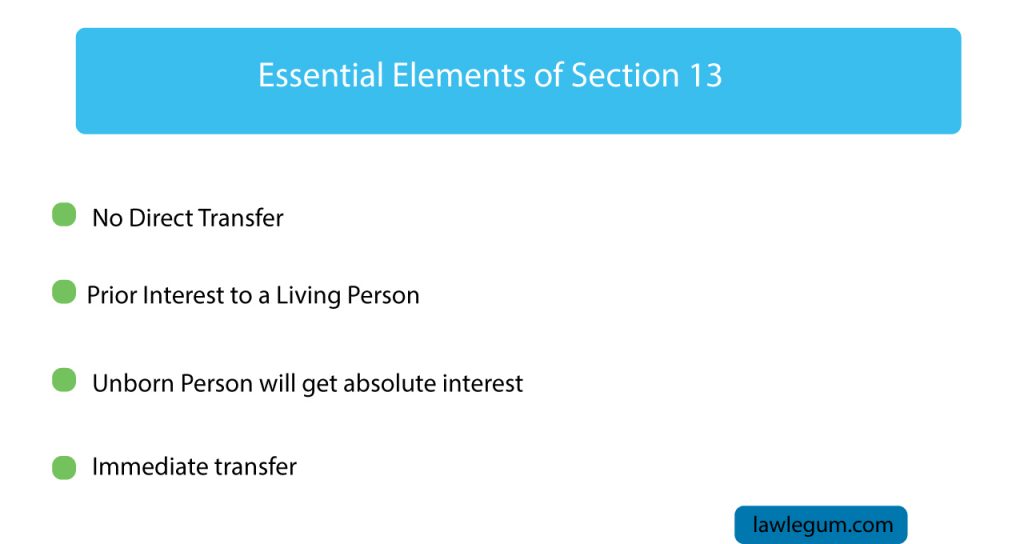

There are certain rules regarding transfer of benefit of unborn persons.

There are two main reasons regarding this rule.

Abeyance: State of Suspension- A property can not be without a owner. There has to be an owner for a property.

Regarding prior interest,

There can’t be limited interest. In limited interest, transfer is invalid. The unborn person will get absolute interest. There can’t be no clause.

When a unborn person is born, he or she will get immediate interest. But max to the extent of attainment of majority which is 18 years. Section 14, talks about it.

There is a landmark case related to this section 13 of Transfer of Property Act, 1882 or TPA 1882.

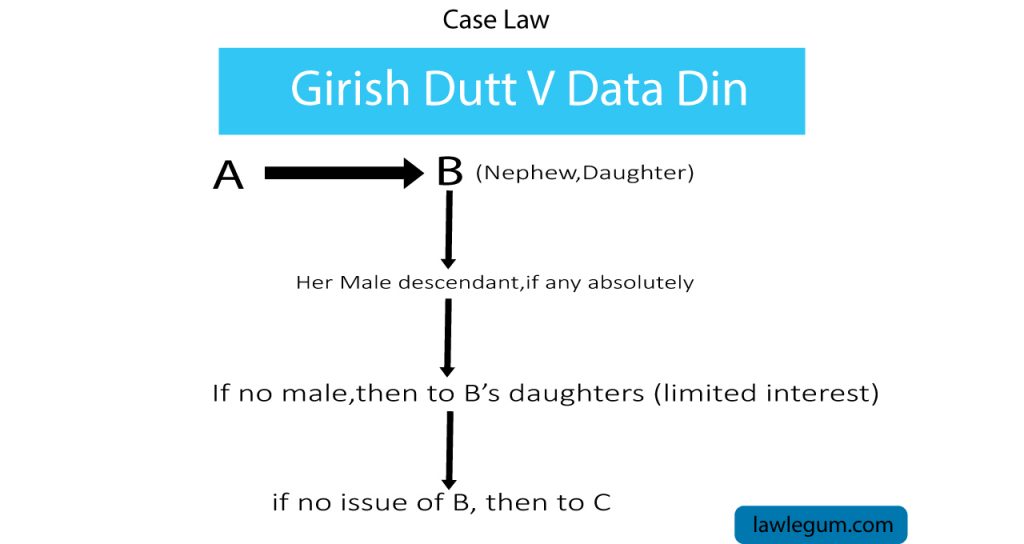

This landmark case name is Girish Dutt V Data Din

In this case, A made a gift to B. Here B is A’s nephew daughter. After B, then to her son or male descendants. If there is any then it will be absolutely. If there is no male descendants then, to B’s daughter or daughters without the power of alienation. That means, limited interested was created regarding B’s daughter/daughters. If there is no sons or daughters of B, then the property will go to C. But B dies issueless.

Now two questions or issues arise in the court.

The court held that gift to B’s unborn daughters was not valid. As there was no prior interest created and also there was limited interest created which is contrary to Section 13 of TPA.

Regarding C, the court also held that, further subsequent gift will also be void according to Section 16 of Transfer of Property Act.

In this blog, we tried to cover all the topics of Section 13 of Transfer of Property Act- Transfer for Benefit of Unborn Persons. Click here to read all the Transfer of Property related articles.